Before we dive into this statistic, we need to understand what realized value means for a crypto asset. Market value, otherwise known as market cap, is simply the total supply of coins multiplied by the current market price. Realized value, on the other hand, discounts for coins lost in inaccessible wallets.

Coins sat in wallets are instead valued using the market price at the time of their last movement. For example, a Bitcoin lost in a wallet since February 2016 will only be valued at around $400.

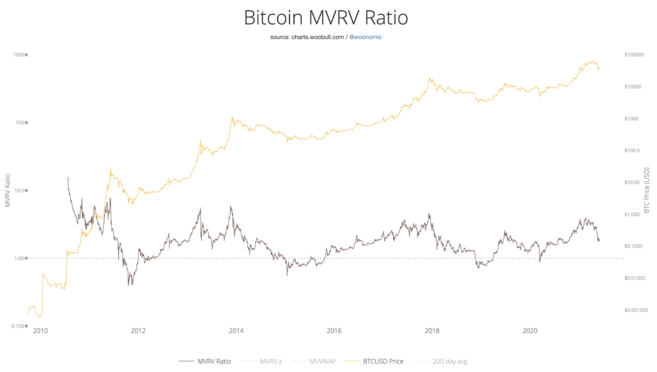

To get our MVRV indicator, we simply divide the market cap by the realized cap. If the market cap is much higher than the realized cap, we’ll end up with a relatively high ratio. A ratio over 3.7 suggests a sell-off may occur as traders take their profits due to the coin’s overvaluation.

This number signifies that the coin may currently be overvalued. You can see this before two large Bitcoin sell-offs in 2014 (MRVR of roughly 6) and 2018 (MRVR of approximately 5). If the value is too low and under 1, the market is undervalued. This situation would be a good point to buy as buying pressure increases and drives up the price.