About Lesson

We probably don’t have to explain this one, do we? The All-Time High is the highest recorded price of an asset. For example, the ATH of Bitcoin during the 2017 bull market was 19,798.86 USDT on the BTC/USDT pair on Binance. This means that this was the highest price that Bitcoin was traded for on this market pair.

One compelling aspect of an asset reaching All-Time High is the idea that almost everyone who ever bought is in profit. If an asset has been in a prolonged bear market, many traders holding losing bags will likely want to exit the market when their position reaches break-even.

However, if the asset breaches its ATH, there aren’t any sellers left who are waiting to exit at break-even. This is why some refer to ATH breaches as “blue sky breakouts,” as there aren’t necessarily any obvious resistance areas ahead.

ATH breaches are also often accompanied by a spike in trading volume. Why? Day traders may also jump on the opportunity with market orders to make a quick profit and sell at a higher price.

Does breaching the ATH mean that the price will just keep going up forever? Of course not. Traders and investors will look to take profits at some point and may set limit orders at certain price levels. This is especially true if previous All-Time High levels keep getting breached again and again.

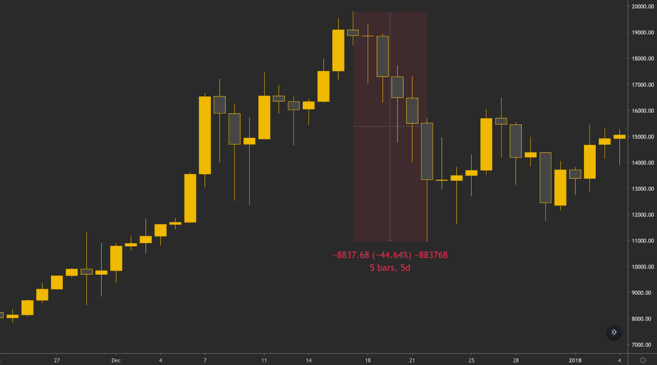

Parabolic moves can often end up in very sharp price drops, as many investors rush to the exit once they realize the uptrend may be coming to an end. Check out the price drop after Bitcoin’s parabolic move to $20,000 in December 2017.

Bitcoin drops from $20,000 to $11,000 in five days.

After reaching an ATH of $19,798.86, Bitcoin dropped almost 45% in a matter of days. This is why it’s always crucial to manage risk and always use a stop-loss.