About Lesson

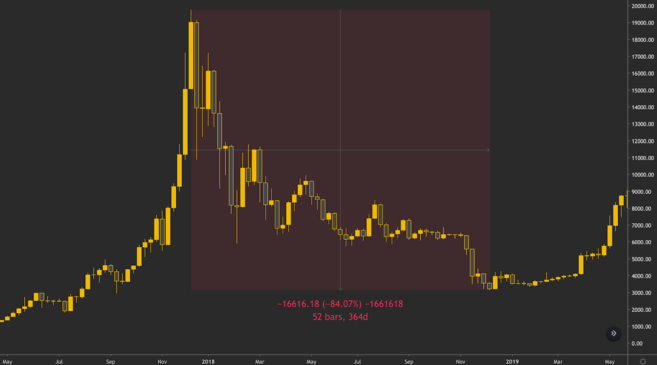

As we’ve discussed, many investors think that Bitcoin has been in a macro bull trend since it started trading. Does that mean there aren’t bear markets contained in that bull run? No. After Bitcoin’s move to around $20,000 in December 2017, it’s had quite a brutal bear market.

Bitcoin price crashes after the 2017 bull market.

And before the 2018 bear market, Bitcoin experienced an 86% drop in 2014.

Bitcoin price crashes 86% from the 2013 top.

As of July 2020, the range of the previous bear market low around $3,000 have been retested but never broken. If that low would have been breached, a stronger argument could be made that a multi-year Bitcoin bear market is still underway.

Bitcoin retesting the range of its previous bear market low.

Since that level has not been broken, the argument can be made that the crash following COVID-19 fears was merely a retest of the range. Still, there are no certainties when it comes to technical analysis, only probabilities.

Other notable bear market examples come from the stock market. The Great Depression, the 2008 Financial Crisis, or the 2020 stock market crash due to the coronavirus pandemic are all noteworthy examples. These events have all caused great damage on Wall Street and impacted stock prices across the board. Market indexes such as the Nasdaq 100, the Dow Jones Industrial Average (DJIA), or the S&P 500 index can experience significant price declines during times like these.