In forex trading, currencies are bought and sold in specific amounts known as lots. Unlike stock markets, these lots of foreign currencies are traded at set values. A lot is typically 100,000 units of the base currency in a pair, but there are smaller amounts you can purchase too, including mini, micro, and nano lots.

|

Lot |

Units |

|

Standard |

100,000 |

|

Mini |

10,000 |

|

Micro |

1,000 |

|

Nano |

100 |

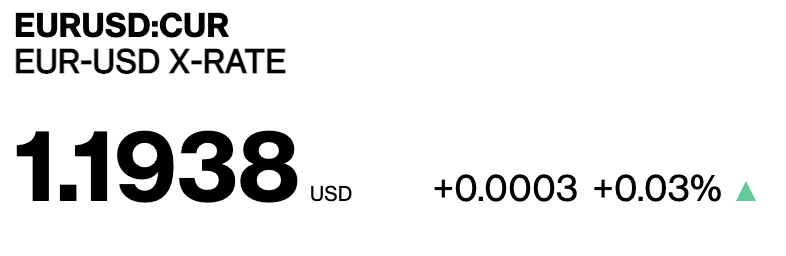

When working with lots, it’s easy to calculate your gains and losses with pip changes. Let’s look at EUR/USD as an example:

If you purchase one standard lot of EUR/USD, you’ve bought €100,000 for $119,380. If the pair increases its price by one pip and you sell your lot, this is equal to a change of 10 units of the quote currency. This appreciation means that you will sell your €100,000 for $119,390 and have made a $10 profit. If the price increases ten pips, then it will be a $100 profit.

As trading has become increasingly digitized, standard lot sizes have decreased in popularity in favor of more flexible options. On the other side of the spectrum, large banks have even increased the size of their standard lots up to 1 million to accommodate the large volume they trade.