About Lesson

Investors can look at market sentiment indicators to get an idea of the bullish or bearish feel of a market or asset. Indicators represent these feelings either graphically or with some kind of scale. These tools can make up a part of your sentiment analysis kit but shouldn’t be relied upon solely. It’s best practice to use multiple indicators to get a more balanced view of the market.

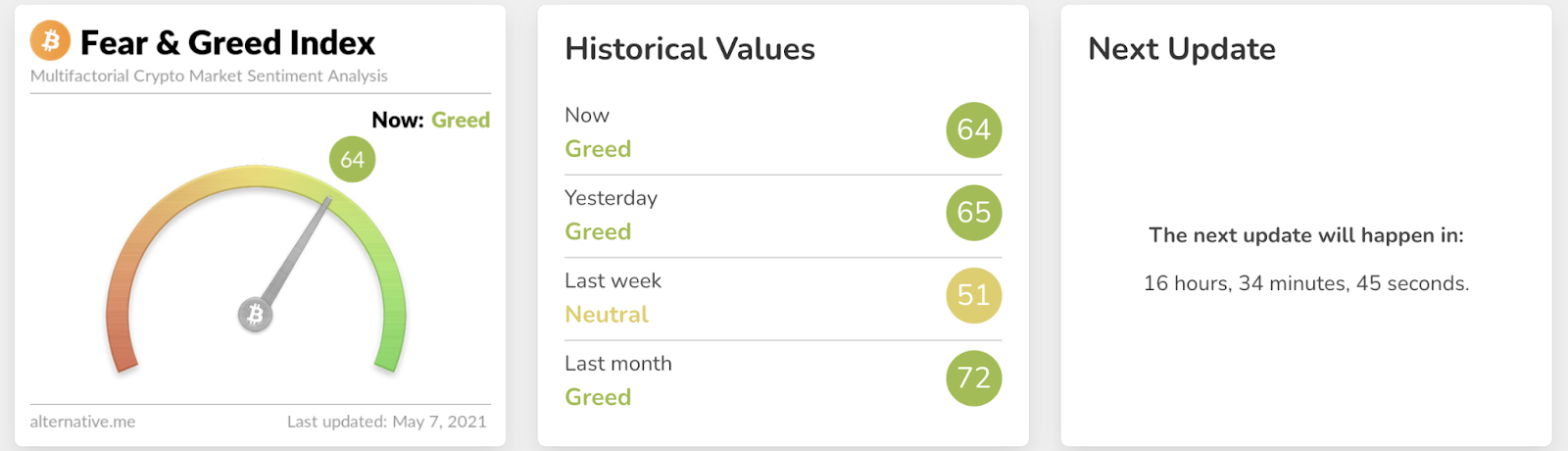

Most market sentiment indicators are focused on Bitcoin (BTC), but you can also find Ethereum (ETH) sentiment indexes. The Bitcoin Crypto Fear & Greed Index is perhaps the most known indicator of crypto market sentiment. The index shows Bitcoin market fear or greed on a scale of zero to 100 by analyzing five different information sources: volatility, market volume, social media, dominance, and trends.

The Bull & Bear Index by Augmento is a different sentiment indicator concentrating on social media. An artificial intelligence (AI) software analyzes 93 sentiments and topics using conversations on Twitter, Reddit, and Bitcointalk. The creators also backtest their indicator’s methodology with the year’s worth of data available. Zero is extremely bearish on the scale and one extremely bullish.